What is Revenue Forecasting?

Revenue forecasting is a company strategy used to estimate and prepare for the future revenue. It’s the process of predicting how much revenue a company can expect over a set duration of time in order to make data-driven business decisions.

Revenue forecasting is more of an art than a science—for professional services organizations at least. Although the inputs used for financial forecasting methods are quantitative in nature, successful professional services executives will often layer in their perspectives on the business, the market share, or key accounts. Perfecting the qualitative aspect of forecasting business revenue comes with years of experience working in professional services organizations.

The underlying planning and revenue forecasting model, however, is something that every services manager should know how to build, and build well. There are quite a few different financial forecasting methods professional services firms can use for forecasting consulting services.

What Are Types of Revenue Forecasting Models?

Common revenue forecasting models for products or services include: pipeline revenue forecasting model, backlog revenue forecasting model, bottom-up revenue forecasting model (or resource-driven), and revenue forecasting through historical performance and effects of change.

In reality, organizations will mix and match various models to develop the most accurate forecasting method they can. Given that there are many different ways to forecast revenue using predictive analytics, here are a few of the most common revenue forecasting methods.

The Pipeline Revenue Forecasting Model

The pipeline revenue forecasting model involves tracking and measuring the organization’s future sales — or their sales pipeline. The idea being that some percentage of the sales forecast will turn into real work. The tricky part with this approach is trying take an educated guess around what the size of each deal will be, and what the “some percentage” of the pipeline is. Many organizations will use the percent likelihood of an opportunity, represented by the stage it is in, to factor the total revenue forecast.

That being said, it is usually not until much later in the sales process that a reasonable estimation for size and duration is made. This limits how far into the future this type of forecast can reach.

Strengths

- Pipeline data is usually accessible and easy to understand.

- Historical win rates can add confidence to the model.

Weaknesses

- Sales team could be overly optimistic, leading to inflated projections.

- Doesn’t include in-process work.

- Doesn’t provide great detail for when the revenue will be earned.

The Backlog Revenue Forecasting Model

Similar to the pipeline approach, using your backlog for financial forecasting involves looking at the total amount of revenue that your organization has contracted but has not yet earned. When using backlog as a revenue forecasting model, you don’t need to worry as much about factoring for uncertainty, but rather realistically distributing the revenue growth over time. This distribution can be done by calculating the typical run rate of your team for a given period and dividing that into the total revenue figure.

This calculation will represent about how long it will take the organization, at its current size, to earn what is currently in the backlog. This approach works well when a high-level view of the growth rate is all that the organization requires. It also assumes the organization has a historical track record of delivering work very similar to what’s in the backlog. Quite often, professional services organizations will sync their backlog with their pipeline to build a more holistic, long term revenue forecast.

Strengths

- Easy to calculate.

- Doesn’t require heavy factoring.

- Can be utilized for demand capacity planning.

Weaknesses

- The timing of revenue is an approximation.

- Only valuable as a planning tool.

The Resource-Driven Revenue Forecasting Model (Or Bottom-Up Forecasting)

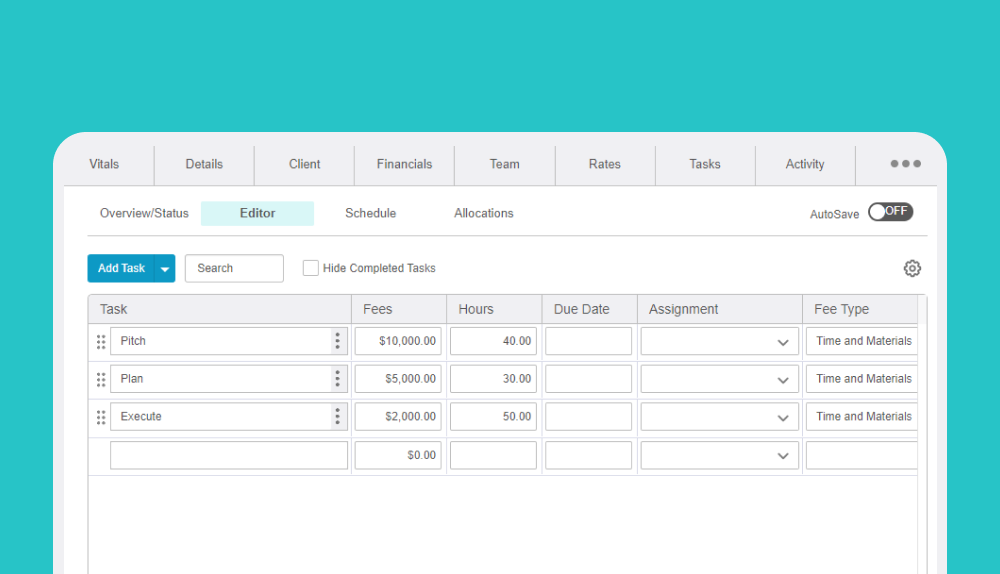

Resource-driven forecasting, also known as bottom-up forecasting, allows teams to schedule all of their planned work and match the right resources to projects accordingly, using resource scheduling software and their best judgement. Planned work includes both projects in the proposal phase and also projects currently underway. Then, an organization can translate the scheduled work into accurate, time-phased revenue forecasts, providing insight into an organization’s capacity to successfully deliver the work within the estimated time of completion.

This transparency provides teams with a clear understanding of the project pipeline but also allows resource schedulers to mindfully balance resources across the organization’s project workload. Resource-driven forecasts should be monitored on an ongoing basis and adjusted accordingly to highlight capacity shortfalls and surpluses, call attention to projects that are both ahead and behind schedule, and incorporate new work that enters the sales pipeline.

Strengths

- Very accurate and detailed forecast.

- Can include both pipeline and in process work.

- Adjusts as project managers make schedule changes.

- Useful for highlighting capacity shortfalls or surpluses.

- Useful for highlighting projects that are ahead or behind schedule.

Weaknesses

- Requires disciplined process to ensure accurate resource bookings.

- A sophisticated resource management tool is needed to decentralize the process properly.

Revenue Forecasting Through Historical Performance and Effects of Change

For organizations that run a recurring revenue business model, such as managed service providers, this approach may work well. It involves assuming the organization will earn at least the same amount of revenue this current period as it did during the same period in the past. With historical performance as a baseline, current conditions are then analyzed to assess how they may affect that performance. Winning or losing a major client, introducing a new service line, or outside market factors are all examples of events that should be taken into account.

Strengths

- Can be performed quickly.

- Takes into account market factors in addition to backlog and pipeline.

- Can be performed in tandem with other approaches.

Weaknesses

- Requires in-depth understanding of the firm, and the market it operates in.

- Needs to be consistently assessed for accuracy.

- Doesn’t highlight capacity requirements.

- Not appropriate for traditional services business models.

How to Forecast Revenue for Consulting and Professional Services Firms

So how do consulting firms actually forecast their revenue? The real answer is likely some version of “all of the above” as their professional services financial model. Not only does every professional services organization approach revenue forecasting differently, but each one will also use a different mix of the techniques discussed above to come up with their final number.

Combining the backlog revenue forecasting model, a bottom up forecasting approach, and the pipeline revenue forecasting method would be an example of how this might play out in a real-world setting. Organizations that champion this forecasting process typically utilize revenue management software and revenue forecasting software via a professional services automation (PSA) tool to aggregate and validate their predictions.

For standardized, repeatable work that has already been won, the organization may use their backlog to get a high-level view of revenue forecasts. Committed work that demands customization may require the addition of bottom-up forecasting, or the resource-driven plan.

From there, it may make sense to layer on pipeline work by using opportunity size, start date, duration, and likelihood to then model uncommitted revenue. This consideration allows the organization to accurately time-phase their revenue management forecasting and also commit to capacity planning around how they will deliver the work. Because resource-driven models understand capacity beyond the resource dimension (e.g. titles, departments, offices), the revenue forecast is useful for many decision-making processes.

What All Revenue Forecasting Has in Common

Regardless of which revenue forecasting model an organization chooses, there is one thing that all professional services organizations must do—check their work. Financial forecasting methods are only useful if they can be trusted. Professional services organizations need to be consistently measuring how accurately they can forecast work. If accuracy is lacking, then it’s time to evaluate a new approach. Now let’s take a look at some of the common issues that come up during revenue forecasting, and how to avoid them.

Revenue Forecasting Mistakes

Professional services firms live and die by their ability to forecast revenue. Although there are many types of forecasting that service firms perform—utilization, profitability, or backlog—they all tie into an underlying revenue forecast. Get your revenue forecasting right, and you have an appropriately sized firm that has a healthy service mix. Make revenue forecasting mistakes, and you will be under or over staffed in key areas and suffer from low utilization rates, high turnover, or a general lack of direction.

This is why revenue forecasts are so important. Unfortunately, they don’t always receive the attention they deserve.

One thing that separates high-performing professional services firms with a solid growth strategy from their peers is their ability to reliably make revenue projections. While there is no one size fits all approach, we will dive into six common resource-driven revenue forecasting mistakes that services firms make along their journey to the top. These mistakes often arise at companies that are growing rapidly, or simply do not have the proper tools to model their business.

Revenue Forecasting Mistake #1: Schedule Your People

In top-performing professional services firms, you’ll often find quite a bit of attention paid to matching people with the right project and scheduling out work. Resource scheduling software is central to this process and these firms routinely have an entire group of resource managers that control the flow of people and work.

Less disciplined firms often skip this step claiming that they don’t have enough time or the future is too opaque to commit to. Whereas in reality, project managers are still building schedules for their projects, they just aren’t doing it in a consistent and measurable fashion. They are building Excel spreadsheets or utilizing personal calendars. This valuable information is then lost to the firm’s decision makers and staffing, profitability, or growth issues arise on a regular basis.

As such, the scheduling process should be decentralized and focused on the best estimate at the time. Project managers should be responsible for updating the schedules on all of their projects on a regular basis. If they don’t know who will perform the work yet, they should be utilizing unnamed resource placeholders to model the work. With a consistent process in place, the organization will have the underlying data it needs to begin building a revenue forecast that represents when the revenue is earned, instead of ambiguous backlog totals.

Scheduling and Revenue Forecasts in Action

We recently worked with a smaller (about 25 people), but sophisticated, services firm that was a remarkable example of the value of this approach. They employed a simple rule: If the person isn’t scheduled on your project, they aren’t working on it. It doesn’t matter if the work is last minute and happening tomorrow or if it might happen sometime next month, project managers were expected to keep up-to-date project schedules.

From the project manager’s perspective, this added about 20 minutes of administrative work to their day, but it was work they were already doing—albeit in a different medium. From the leadership team’s perspective, this provided a treasure trove of data that they could use to make more impactful decisions.

The leadership team utilized a series of automated dashboards to translate the schedule information into revenue forecasts and then compared forecasted revenue to the firm’s revenue potential. They set benchmarks for themselves to achieve and managed the flow of work to ensure healthy utilization, profitability, and backlog. Having actionable information available to them has enabled them to maintain utilization rates will above the market average, as well as grow the size of their firm with healthy margins.

Revenue Forecasting Mistake #2: Get Your Rates Right!

Scheduling your team, no matter the size, is important. It’s the first step to building a reliable revenue forecast. Once you have that information it needs to be translated into revenue. That’s where rates come in.

Billing rates are a relatively straightforward concept. Unfortunately, because rates are easy to grasp, much of the nuance of rate management can get lost in revenue forecasts. It’s possible that every type of person in your organization carries a standard rate, but every contract you negotiate may represent a discount to that rate.

Furthermore, different types of work may bring different rates. If a professional services firm simply says “we bill at $175 an hour” and derives their revenue forecast from that rate, it’s likely that they will be overstating their earning potential. As such, rates should be tied to the most granular item they can be—ideally each scheduled hour.

The story becomes a bit more complicated if you manage fixed price contracts for projects. The tendency is to view this type of work as easier to forecast because the price is fixed, but the total value of the work is not the only component.

Professional services firms must also consider when the revenue will be realized. Unless you’re running your services business on a cash basis, matching revenue with when work is performed is critical. For work that has already been performed, revenue recognition software allocates the proper amount to each hour worked. Future hours, on the other hand, need to have revenue assigned to them based on the value of the contract that is remaining.

Revenue Forecasting Mistake #3: Not All Projects Are Created Equal

With a reliable schedule and realistic rates in place, a revenue forecast starts to form. From here it’s imperative the professional services firms begin to segment the types of projects that revenue is forecasted to.

Quite a bit of attention is often paid to pipeline projects to downplay their effect on the overall estimate. We know that not every single project will be won, and we have information about projects in different stages of the sales cycle (opportunity vs. proposal). So it comes as no surprise that the revenue those projects represent should be factored down.

What is overlooked, however, are the projects at the other end of the project life cycle—those that are in an at-risk state. These projects could either stop abruptly or start collecting a lot of non-billable work to correct them.

Regardless of how those at-risk projects are managed off the brink, it’s likely that they are representing revenue that will never be earned. Service firms should either adjust forward-looking rates on these projects appropriately or establish a reasonable way to factor the revenue associated with at-risk work to avoid revenue leakage.

Revenue Forecast Mistake #4: Make Sure That Schedule is Up-to-Date

Using a resource schedule to build a forecast from the bottom up is one of the most precise ways to model revenue. But when things change, and they will, if managers don’t update the schedule their revenue predictions will become increasingly inaccurate. There are often two ways schedules become out of date at a professional services firm—short-term changes and long-term delays.

Every project manager is familiar with making short-term adjustments to keep their plans on track. What project managers often overlook, however, is the ripple effect that those changes have on other projects in the organization. Pulling in additional resources, diverting a senior team member, or just allocating more time to a task will have an impact on the near-term revenue forecast. Professional services firms that use centralized resource scheduling software can model this adjustment and update their forecasts in real-time.

As the flow of work evolves, so will the schedule. It is no secret that these changes will influence a firm’s revenue forecast. What is important is that a firm promptly documents these changes in their resource schedule. Failure to update the schedule promptly will influence numerous decisions in both the sales and delivery operations of the business. From over-committing resources to overstating revenue, the closer to real-time a professional services firm’s data the more useful it will be for decision-making.

Revenue Forecast Mistake #5: Understand and Factor for Variability

Successful professional services firms need to be flexible, and the result of flexibility is variability in revenue forecasts. Forecasting for the next one or two months is straightforward and actual revenue will likely be within 5% of the estimate. Forecasts six to 12 months out are much more variable and could be off by 20% or more. But what if you could measure, predict, and then plan for variability?

Understanding and measuring variability will provide valuable insights. In fact, one of our client’s experience with predicting professional services variability has turned into competitive advantage. The short version of that story is that it turns out professional services variability tends to be consistent. Consistent variability means that predicting it with a reasonable level of accuracy is achievable, provided you have the right tools.

Revenue Forecast Mistake #6: Know the Difference between Revenue and Cash Flow

This tends to be an issue for rapidly expanding professional services firms where cash is king, but it is necessary for any service manager nonetheless. Revenue forecasts and cash forecasts are two closely related, but very different things. Growing firms will often put an emphasis on cash flow because it is what keeps the business running. Cash forecasting is essential, for sure, but foregoing a revenue forecast can lead to issues down the line.

This is because cash forecasts focus on financial activities, such invoicing and collections, while revenue forecasts focus on operational activities, such as project staffing. While a healthy cash forecast can help you understand if you can keep the lights on, it will not highlight if the organization has the right resource mix to deliver the work it has won.

Forecasting revenue becomes even more necessary for managing fixed price projects. Understanding actual effort to date and the estimated effort to complete a fixed price project provides project managers with tools to test the health of their engagement. The estimated effort to complete component is what aggregates into a firm’s revenue forecast and helps increase the accuracy of the revenue recognition process. These are two areas where forecasting cash simply will not help.

How to Get Started with Consolidated Revenue Forecasting

If any of these common revenue forecasting mistakes sound familiar to you, they’re likely the result of a troublesome platform or process. It could be that your schedules all live in Excel files and you don’t have the sophistication you need in your tool set to aggregate and disseminate the information quickly. Alternatively, the processes you follow could be leading to stale or untrustworthy information.

A professional services organization could also be having a hard time getting the all of the data needed in one place because of a highly centralized process. The most successful professional services firms address these issues by utilizing a professional services automation solution as revenue forecasting software. PSA tools help services firms model and measure forecasted work by decentralizing the scheduling workflow and quickly providing a consolidated view of the organization.

If you’d like to learn more about how PSA software can help with revenue planning and forecasting, download our e-book, Professional Services Automation: A Quick Primer.

Frequently Asked Questions About Revenue Forecasting

What is revenue forecasting?

Revenue forecasting is a company strategy used to estimate and prepare for the future revenue. It’s the process of predicting how much revenue a company can expect over a set duration of time in order to make data-driven business decisions.

What are four revenue forecasting models used to predict revenue?

Four types of revenue forecasting models include the pipeline revenue forecasting model, resource-driven forecasting model, revenue forecasting through historical data model, and using your backlog for financial forecasting.

Why is revenue forecasting important?

Revenue forecasting is important because if you get your revenue forecasting right, you have an appropriately sized firm that has a healthy service mix. Get your revenue prediction models wrong, and you will be under or over staffed in key areas and suffer from low utilization rates, high turnover, or a general lack of direction.

How to forecast revenue based on historical data?

With historical performance as a baseline, current conditions are then analyzed to assess how they may affect that performance. This is based on the assumption that the organization will earn at least the same amount of revenue this current period as it did during the same period in the past.

What is bottom-up forecasting?

Bottom-up forecasting, or resource-driven forecasting, allows teams to schedule all of their planned work and match the right resources to projects accordingly, using resource scheduling software and their best judgement.

What’s the difference between a revenue forecasting model and a revenue projection model?

Revenue projection models are more useful when you want to predict what will happen based on the assumption that things won’t change, while revenue forecasting models are better at helping businesses identify trends so strategies can be adjusted accordingly.

.png)