What is Project Accounting?

What Are Different Names for Project Accounting?

Project accounting is a method that services organizations use to drive outcomes for projects and portfolios of projects. Now that we understand what is project accounting, it can also be helpful to be aware of the many terms project Accounting might also be referred to as. For example:

- Job Accounting

- Job Tracking

- Project Accounting

- Project Management Accounting

- Project Accounting Sub-Ledger

- Project Accounting Software

- Financial Statements for Project Management

- Project Management Financial Tracking

- Project Cost Accounting

- Project Based Accounting

- Job Cost Accounting

- Cost Accounting

Beyond the concept of what is project accounting, there are a ton of other accounting terms to distract you, such as ASC 606 compliance, GAAP, revenue recognition, AR, AP, GL, WIP revenue, deferred revenue, accrual, cash basis, and more. Don’t worry about any of these (yet), by the end of this post you will understand the basics surrounding what is project accounting and be able to put the accompanying terms into practice quickly.

What is the Difference Between Financial Accounting, Management Accounting and Project Accounting?

Glad you asked! There are many differences when thinking about what is project accounting versus financial accounting versus management accounting. The important things to know are duration and usage. Here are a few concepts to focus on:

- Financial Accounting – Financial accounting manages ongoing business concerns that need to be measured. Focused on cost centers (departments), financial accounting’s duration is fixed to a year. Questions like, “what was our revenue in 2020?” can be answered with Financial Accounting. Ultimately, financial accounting is the single source of truth that gets reported to auditors.

- Management Accounting – Is not about keeping score, it is about finding meaning from financial accounting. Think about management accounting as the sense maker to the noise that financial accounting creates. For example, if we book 3x more business this month than in the previous month none of that will get seen by financial accounting. Management accounting uses that information to inform the business on where to go.

- Project Accounting – Projects have costs like billable resources and expenses, which create value for the business in the form of revenue. Those costs and revenue can be created regardless of the cost center they exist in. When project accounting software is used as a project accounting subledger, these project costs then get mapped into the right cost centers to provide the business with a financial accounting perspective.

A simple way to think about this is the applicability based on the situation. When thinking about what is project accounting and what it applies to, project accounting is used internally for project work at a micro level. Management accounting is more to track day-to-day business. Financial accounting is the cold hard facts that get reported externally to auditors. They all work off the same foundation, they are just used in different situations to accomplish different tasks.

Who Uses Project Accounting?

Typically, project accounting is used by Professional Services Organizations (PSOs) that use an accrual-based accounting method. This typically means these organizations are over $5M in annual revenue (otherwise organizations may use the cash-based accounting method). A PSO would use project accounting if they are:

- People-centric, meaning they sell their time as a product

- Project focused, meaning their work has distinctive start and end points

- Selling different contract types, including fixed price, time and materials, not to exceed etc.

- Focused more on labor than material factors (project accounting can sometimes deal with materials and inventory)

- Delivering work in different global locations

- Delivering knowledge-based services

- Delivering projects with a variety of resources and workstreams

Good examples of organizations who use project accounting:

- Tech implementers

- Systems integrators

- Management consulting firms

- Accounting firms

- Creative agencies

- Engineering services

- Digital agencies

- Software companies implementing their own technology

- Architecture firms

- Financial services organizations

Bonus: Download a free guide to unlock tools and strategies for optimizing project accounting to grow your services and profits!

Why Should I Use Project Accounting?

The easy answer here is: to manage your services organization better… but that is a bit simplistic. There are three core reasons:

- GAIN INSIGHT FROM OUTPUT: The first is to empower project managers with insight into the financial performance of a single project amongst a portfolio of projects.

- MANAGEMENT THROUGH INPUT: With that insight, project managers now have the ability to actually manage the balance of resources, project plan and budget before something goes off the rails.

- ALIGNMENT: As a project manager goes about their work, project accounting software helps them to align their work to the overall performance goals of the business.

It is the combination of these three things that unlock improvement in business performance.

Think about it like this: The steam engine was invented in 1712 but innovation on the steam engine didn’t happen until James Watt optimized its use in 1778. Why is that? Why did it take so long to improve? One word: horsepower (i.e., output). That’s right, James Watt invented the metric of horsepower so that he had a baseline of measurement to compare against. He used this metric to measure output so that he could optimize input. Project accounting is the horsepower of professional services organizations. I hope all project managers now feel a little bit cooler!

View the full webinar for next-step strategies and solutions when you start to outgrow your project accounting system.

What Are the Benefits of Project Accounting?

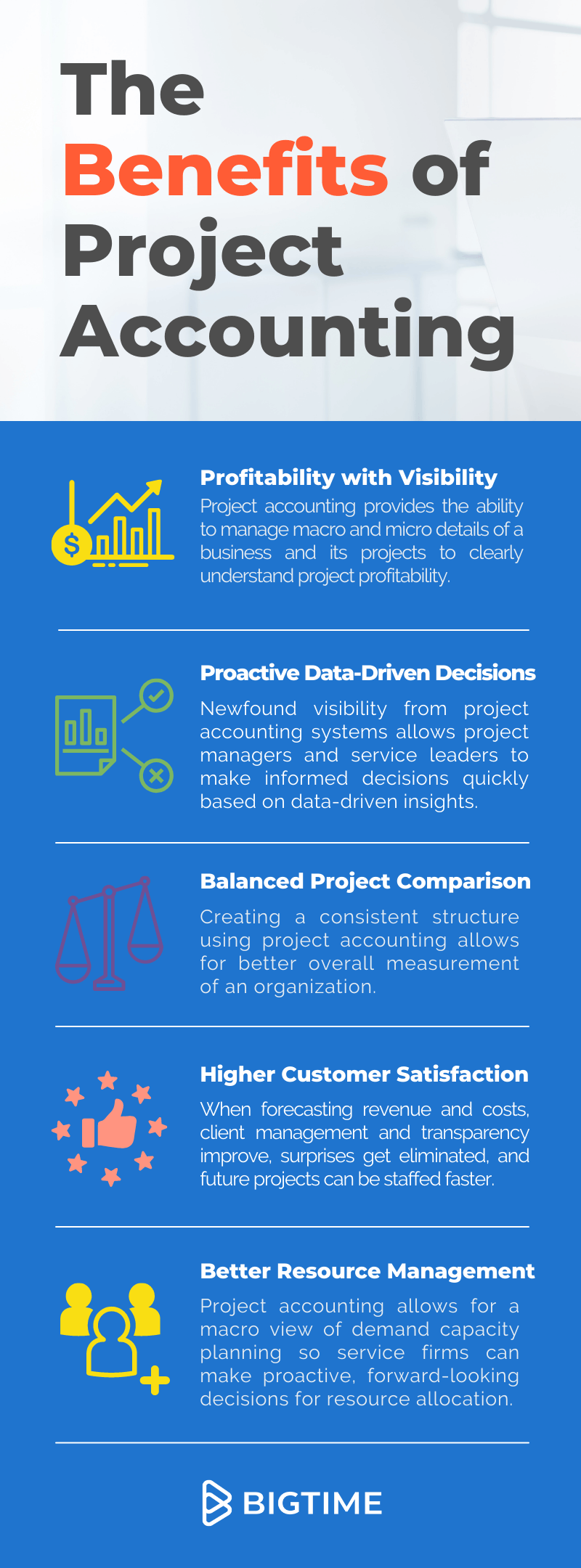

When thinking about why you might want to use project accounting software, there are a five key benefits that you get to enjoy when implemented:

- Profitability: Macro and Micro Visibility

“Watch your pennies and the dollars will take care of themselves” is something that was coined (sorry for the pun) by William Lowndes a former secretary to the treasury of Great Britain. That concept holds true for project accounting. If each project is well-managed, the overall performance of the organization will take care of itself. Project accounting gives us the ability to manage both the macro and micro details of the organization and any given project, allowing us to gain a clear understanding of project profitability.

A project profitability analysis is an analytical construct that can be easily achieved using project accounting software. A project profitability analysis compares the revenue generated by doing work for a customer vs. the cost to the organization for delivering the services. - Proactive Data-Driven Decisions

With newfound visibility from project accounting systems comes the ability to make informed decisions. If a project is risking a budget overrun, the project manager can impact the success of the project with scope and resource changes. Quick decision-making through data-driven insights helps to separate the only okay and great services organizations. - Balanced Project Comparison

If every project manager comes up with their own method to manage project costs, billing and revenue, there is no way to compare how projects are doing collectively across the organization. Creating a consistent structure allows for better overall measurement of your organization. - Higher Customer Satisfaction

No one wants to tell a customer about a budget overrun. Using project accounting, services organizations can get in front of overruns and major risk points. By forecasting revenue and costs, client management and transparency becomes much easier and surprises get eliminated. Beyond that, by eliminating overruns resources get freed up for faster staffing to the next project, thus optimizing your billable utilization. - Better Resource Management

Undoubtedly, the most important part of any services organization is people. Leveraging project accounting allows for the macro view of demand capacity planning. No one wants to refuse a project due to lack of bandwidth, but with project accounting, your organization is fed a proactive, forward-looking resource plan.

What is a Practical Project Accounting Example?

For this example, let’s assume that we are implementing a new CRM. We sold the fixed price project contract for $120k because it de-risked our customer from any project overages. However, it means we need some discipline to deliver on budget.

So what are the basic steps of how this works in this project accounting example?

- Identify the Contract Type and Terms – we already know it is a fixed price project. This means no matter how much time we put into the work, it will never exceed the $120k without a change order. While there are other professional services contract types to consider, let’s keep things simple. There are four milestones in the scope – definition, development, testing and roll out. Payment was agreed to be $20k up front and $25k per milestone.

- Understand the Budget – we booked the work at $120k but we budgeted to get a 40% profit margin on the project, so our budgeted cost is $72,000. That budget needs to take into account all of our project costs, for example time & expenses. To keep things simple, let’s just use time. We have forecasted for this project to have three resources working for 120 hours each at $200 hour.

- Assign the Resources – we need a project manager, systems architect and a developer (at our $200 hourly rate) which means all three resources are mid-level. We won’t dive into it here, but this supply and demand mapping is critical to optimize profitability in a services organization. We recently wrote all about demand planning if you want to learn how services organization can work like Amazon.com.

- Plan the Project – build out the project plan and work break down structure, assigning tasks to resources and identifying the four milestones that need to be delivered. Most importantly, establish some sort of regular communication with the customer to manage expectations and progress, milestones and billing.

- Deliver – now the fun begins! This is when we start to fire on all cylinders for our customer and day-to-day accounting comes into play. Time has to be tracked, expenses need to be entered and invoices sent to customers. In our hypothetical example we are doing really well as we complete the “definition” milestone. So, based on project accounting rules how much revenue have we recognized knowing that we have collected $45k in payment and we are 25% through the project?

If you guessed $30k, congrats! You are correct. You are 25% complete with the project. However, there is a discrepancy between how much we have been paid and how much revenue we have recognized. That remaining $15k that we have been paid is considered deferred revenue. Another term that may come up not specifically highlighted above is WIP revenue which stands for “work in progress revenue”. This is typically referring to revenue earned while a project is still underway.

- PRO-TIP #1: Forecast the Future: Rolling this simplistic example up across all projects starts to give an interesting view into the performance of the business. Even more interesting is predicting what your revenue recognition will be months into the future. At Projector by BigTime, we call this RevenueIQ. This is the foundation that project accounting sets you up for.

- PRO TIP #2: Work Smarter, Not Harder: Bad news – it isn’t that easy, Each project has unique complications, and PSOs can be working on tens or hundreds of projects at a time. The operations behind the work can become too complex, leading to difficulties across every level of the organization. The best services organization automate this behind-the-scenes work with a PSA tool.

Where Do I Start With Project Accounting?

Where you should start really depends on two things; the goals and maturity curve of your organization. Let’s start with goals:

- Utilization: “I need to improve billable utilization by…”: A common goal is simply the improvement of billable utilization. By leveraging project accounting methods, the clarity of who is spending time on which project becomes crystal clear at both the micro project level and the macro project portfolio level. This allows an organization to optimize its utilization rates.

- Profitability: “I need to improve project profitability by…”: This tends to be the key reason services organization start with project accounting. They have goals to improve project profitability, and they believe that project accounting software is how they will achieve those goals.

- Delivery: “I need to improve NPS by…”: As organizations wade into project accounting, delivery starts to be put on the back burner. It is critical that we walk and chew bubble gum at the same time. Typically measured in NPS or CSTAT, if you can’t deliver, there just simply won’t be more work.

- Growth: “I need a YoY growth rate of…”: Typically growth is where services organization first set their goals. However, without balancing the three goals listed above, growth just becomes hard to execute on.

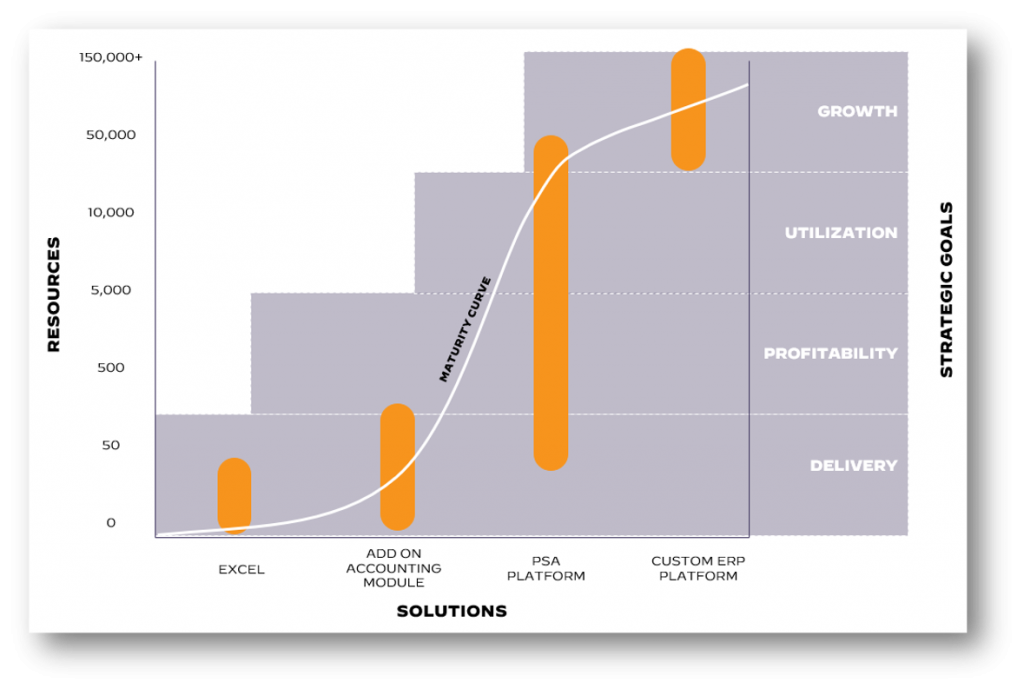

There is also a maturity curve that comes into play here as well. Typically, there are four varieties of solutions that an organization can use:

- Excel: Trusty ole excel is an easy way to manage a single project if you know what you are doing. Once an organization gets larger this becomes totally untenable. The tell-tale sign you have outgrown this solution is the number of people in FP&A working on non-strategic project focused analysis.

- Accounting Add-Ons: Accounting tools like QuickBooks are great for simple general ledger management but they do not embrace the concept of project accounting. There are some point solution focused add-ons available, however, this would only be recommended if growth was not a priority.

- Professional Services Automation Software: PSA tools tend to be the platform of choice for the majority of services organizations since they can serve as a project accounting subledger. More importantly, by capturing day to day data like contract type, resources, time and expense, PSA applications automate all of the project accounting principles. However, not all PSAs are created equal.Some focus more on project management and collaboration – if your focus is on project accounting, this isn’t the best option. Other PSAs are built on CRM technology to drive a better connection to sales and services handoff. This is a good option if you are trying to fix sale and services connectivity. Finally there are platforms that are built specifically for project operations – which are the optimal choice for project accounting. Some good questions to ask when searching:

- What performance does your PSA application drive? (If you want to check that performance for yourself – download the SPI Benchmark. This independent survey rates PSA vendor performance.)

- Can you provide a real-time forecast of revenue recognition in the future?

- Is your PSA software purpose built for project accounting or is it built on a CRM?

- Do I have to customize your solution or does it come configured already for services organizations?

- Does your PSA system act as a project accounting subledger?

- ERP: This is typically the go-to option for a very large (25k+ resources) services organization. Customized to your heart’s content, it serves as the centerpiece for the whole organization from CRM to Accounting and everything in between. This is a great option if you have really deep pockets and a dedicated IT team that will support and develop on top of the platform you choose.

Interestingly, each of the solutions listed above do not equally unlock all of goals / needs we outlined. In general, the way to think about each option is as you move left to right on solution maturity in the graph below, more of those goals typically start to get unlocked. That should give you a good idea of where to start your search.

Summarizing What is Project Accounting and How to Optimize It

So what is project accounting? Project accounting tracks project costs based on the accrual method, measuring revenue, cost, and profitability or a project or project portfolio. Additionally, because it is ongoing, project accounting requires close monitoring of the project throughout its lifecycle and recognizes early warning signs that might lead to issues affecting profits.

Project accounting is critical to a successful services business, as it enables self-awareness and transparency, while providing the information needed to adjust and manage performance. Project management accounting software is fundamentally different than a financial accounting system, and is a tried and true method for services organizations to drive better resource utilization. Other benefits of implementing project cost accounting software include improving profitability and predictability, delivering great work and ultimately growing your organization.

Enabling organizations to manage the cost, revenue and billing of a single project ensures that the entirety of the organization is managed in a consistent way. There are a number of solutions that exist on the market – and the one that will work best for you and your organization totally depends. Reach out to a software specialist for a complimentary consultation on how to approach automating your project accounting.

Frequently Asked Questions About Project Accounting

What is project accounting?

Project accounting, also known as project cost accounting or project based accounting, is a type of accrual accounting that measures revenue, cost, and profitability of a project or portfolio of projects. Project accounting is a particularly critical practice for professional services firms as they deliver projects to clients as their core business.

What are different names for project accounting?

Project accounting is a method that services organizations use to drive outcomes for projects and portfolios of projects. Project Accounting might also be referred to as:

• Job Accounting

• Job Tracking

• Project Accounting

• Project Management Accounting

• Project Accounting Management

• Project Accounting Sub-Ledger

• Project Accounting Software

• Financial Statements for Project Management

• Project Management Financial Tracking

• Project Cost Accounting

• Job Cost Accounting

• Project Based Accounting

• Cost Accounting

How is project accounting different from financial accounting?

The important things to know are duration and usage. Financial accounting manages ongoing business concerns that need to be measured, is the single source of truth reported to auditors, and is focused on cost centers (departments) with a duration fixed to a year. Project accounting is focused on tasks and projects with durations having a start and end date based on a project timeline.

Who uses project accounting?

Typically, project accounting is used by Professional Services Organizations (PSOs) or consulting firms that use an accrual-based accounting method. This typically means these organizations are over $5M in annual revenue (otherwise organizations may use the cash-based accounting method).

What is the purpose of project accounting?

The purpose of project accounting is that it allows professional services organizations to manage their businesses better. 5 key benefits of project accounting include:

1. Profitability: Macro and Micro Visibility

2. Proactive Data-Driven Decisions

3. Balanced Project Comparison

4. Higher Customer Satisfaction

5. Better Resource Management

Why is project accounting important?

There are five important reasons for professional services organizations to utilize project accounting:

1. To achieve profitability (macro and micro visibility)

2. To make proactive, data-driven decisions

3. To have balanced project comparisons

4. To increase customer satisfaction

5. To improve resource management

What is project accounting software?

Project Accounting Software empowers service leaders to focus on reve

.png)